The International and Multi-Regional Membership Center of Latinos in the USA

Welcome to you all!

Mexico and Hispanoamerica a Trade Empire

PuraVidaCommunity

Introduction (by PVC)

In the international scene of politics and economics, one of the primary objectives of any national government is

to promote and preserve the health, peace, education and prosperity of their citizens. When these objectives are

achieved the county as entire entity flourish bringing happiness, progress and stability to its institutions and to its

citizens.

The recipe sounds rather simplistic and easily attainable, however, the economies of all nations of the world have

interweaved in a real mesh of commercial arrangements interchanging products and services. This phenomenon

has strengthened the economic ties with one another and thus the recipe for happiness and progress has to find

new methods and new social challenges to conquer within a new trend to globalize economic participation of

each nation.

A traditionally welcomed and applauded nationalism that yesteryears was in practice in many nations of the

world, today is seen as a policy of protectionism with the potential of hurting international commerce and

international political relationships.

In the region of Hispanoamerica, several national leaders are judged as leftist nationalist for their personal

promulgation of nationalistic ideas. Mr. Evo Morales, president of Bolivia is an example of a leftist nationalist

expressing ideas such as “Bolivia First”. The very same language and concepts expressed by Mr. Luis Echeverria

Alvares, president of Mexico (1970 to 1976), postulating one of his most common expressions: “Mexico First”.

The economic and political environment of Hispanoamerica is today a totally different theater. From the northern

border of Mexico to the southern tip of Chile, the region has engaged and established a tremendous amount of

international trade building a large amount of commercial channels with the rest of the world. The largest economies

of the world have a deep interest in the region and many nations have established solid and everyday increasing relationships in the region.

Hispanoamerica Emerging as a Trade Empire

By NESTOR A. TORO

In the realm of world trade, Hispanoamerica seems to be returning to its 15th-century roots.

During that time, explorers such as Christopher Columbus, Hernando Cortez, and Pedro Alvares Cabral stretched Spanish and Portuguese empires into

South America in search of better sea routes for their nations’ gold and spice trades. By the 16th century, the New World provided immense wealth for

the Spanish Empire. For example, Encyclopedia Americana states that for 25 years Madrid received $13 million annually in gold from Peru alone.

By strengthening political ties and employing tariff reductions with both China and the West, the nations of Mexico, Central and South America, and the

Caribbean are set to become a formidable trade bloc.

The Washington Post stated that Hispanoamerica has an impressive combined GDP of $5 trillion and is one of the “richest markets in the world.” It

mentioned “the emergence of Silicon Valley-like startup cultures that have a homegrown flavor and ethos. Startups are being launched in Chile,

Argentina, Brazil and Mexico to create the same Internet niches as companies in the United States and Europe.”

A study by Visa and America Economia shows e-commerce in the region reached $43 billion during 2010, doubling 2009’s total, and continued economic

growth is expected for 2012.

Hispanoamerica’s portfolio of untapped resources is impressive. Venezuela alone holds about 18 percent of the world’s oil reserves. The Amazon basin is

known to possess as much as 20 percent of the world’s freshwater supply. According to the Inter-American Institute for the Cooperation on Agriculture,

“Hispanoamerica is one of the few regions of the world where agriculture production can expand since it holds 42% of that potential globally,”

MercoPress reported.

The UN’s Economic Commission for Hispanoamerica and the Caribbean pairs the region’s booming economy with China’s as “the current global growth

poles.” The Asian giant appears on track to beat the European Union as Hispanoamerica’s second-largest trade partner, after the United States. But the

report also states that the trend “could moderate if bilateral trade is energized following the partnership agreements between the European Union and

Central America, the Caribbean, the Andean Community and, potentially, MERCOSUR [South America’s leading trade bloc].”

Researchers wonder why Sino-Hispanoamerica commerce relations have not taken off further, adding, “It is striking that the countries of

Hispanoamerica and the Caribbean should attribute so much importance (however justified) to negotiations with the European Union…”

Europe, not China, appears to be the new door to Hispanoamerica’s 21st-century global trade.

“The bloc remains one of the globe’s most affluent regions and a formidable actor in the enforcement of world trade rules and business regulation,”

Financial Times stated.

But the Hispanoamerica global-trade machine is just beginning to sputter to life. Once in high gear, it will play a prominent role on the world stage.

Commodities Exporter

In a letter to The Economist, the ambassador for Brazil in London, Roberto Jaguaribe, wrote, “Hispanoamerica countries have long been big exporters of

commodities, the largest markets for which are outside the region. Trade among Hispanoamerica countries, by the way, reached an historic record of

$160 billion…in 2011.”

Indeed, large areas of Hispanoamerica boast merchandise coveted by markets of the developed world. Latin countries are vital extraction and

processing hubs for essential goods and raw materials such as crude oil, grain, iron ore, soybeans, rubber and cotton.

How good is business? The International Monetary Fund (IMF) summarized the outlook: “…external conditions will remain stimulative for much of

Hispanoamerica: The double tailwinds of easy external finance and high commodity prices are likely to persist for a while, though not forever…this

environment creates opportunities for Hispanoamerica—opportunities to build on the resilience and flexibility that has served it so well during the

global crisis of 2008-09.”

In the midst of a troubled economy for the rest of the world, the report highlighted that the financially integrated economies of Brazil, Chile, Colombia,

Mexico, Peru and Uruguay, experienced strong growth, currency appreciation, and primary fiscal surpluses leading to public debt reduction.

The IMF continued, “Hispanoamerica has been at the forefront of financial and capital account liberalization, especially between 1985 and 2000, and

today stands, with Eastern Europe, as one of the emerging market regions with the fewest barriers to financial flows.”

Hispanoamerica has weathered turbulent times remarkably well. And there is much room for growth.

Business Partners

A brief look at some of the integrated Hispanoamerican nations shows they have been building stronger ties with Europe.

Mexico: The world’s top silver exporter was the first Hispanoamerican nation to establish a free trade agreement with the EU.

Peru: The nation is the world’s second-largest silver exporter, third-largest producer of copper, fourth producer of tin, and one of the largest producers

of gold and lead, among others.

On June 12, German Chancellor Angela Merkel advocated the “rapid implementation of an EU free trade deal with Colombia and Peru, saying it was a

good way to foster growth during the eurozone crisis,”Agence-France Presse reported. “Speaking after meeting Peruvian President Ollanta Humala,

Merkel said: ‘Particularly in a situation where some European countries are having economic difficulties, a free-trade agreement with Colombia and Peru

is a good sign to promote growth.

“‘Therefore we want it to come into force quickly,’ the chancellor added.”

Brazil: One of the world’s major iron ore producers, it is also the European Union’s top Hispanoamerican trading partner.

The Latin Business Chronicle provided a vivid description of a recent EU-Brazil transaction: “When German automaker Audi wanted to make a splash

among wealthy Brazilians recently, it invited 12 Brazilian CEOs to fly first class to Istanbul, Turkey. Audi treated them like sultans, put them at the

legendary Ciragan palace and incidentally, let them experience its new A8 model. It ended up selling four of this new luxury model to its guests. This is an

example—somewhat extreme—of how much European companies are ready to invest to gain market shares in Brazil…Last year trade between the two

areas jumped 34.3 percent to 63.6 billion euros (US$85 billion).”

Colombia: In May, the nation activated a long-awaited free trade agreement with the U.S. Along with Peru, the country will soon implement an EU free

trade pact that is expected to further boost its GDP.

“Once infamous for its illicit drug trade and internal strife, Colombia’s efforts to address these issues have paid dividends,” The Globe and Mail stated.

“Since 2002, when the military crackdown on the FARC (Revolutionary Armed Forces of Colombia) began, foreign direct investment (FDI) in Colombia

has surged. Between 2005 and 2010, FDI in mining grew at an average rate of five per cent annually…Indeed, the last 10 years has seen Colombia’s

potential to become a major gold-producing nation reawaken and build on a history of gold production that stretches back to the 1500s. In fact, until

1937, Colombia was the largest gold producer in the Americas. Already, Colombia has risen to become the 19th largest gold producer in the world and 5th

in South America.”

Uruguay: While mostly an agricultural exporter, Montevideo houses the headquarters of Mercosur, the continent’s leading trading bloc. Yet ongoing

talks for a trade agreement between the EU and Mercosur have been hindered by Argentina’s move to re-nationalize the oil company YPF, which had

been previously purchased by the Spanish firm, Repsol.

In May, though, Spain’s Foreign Affairs minister “said that Madrid supports negotiations for a free trade agreement between Mercosur and the

European Union on a ‘region to region’ basis, back stepping from his proposal last April to exclude Argentina following the seizure of YPF from Repsol”

(MercoPress).

Chile: This major copper producer went from a third-world country to having the strongest sovereign bond rating on the continent in less than 30 years.

One of its main moves to get there was astute: reducing tariffs and signing an incredible number of free trade agreements—as many as 59—including

pacts with the United States, European Union, China, India and South Korea.

Years after Chile’s then-President Ricardo Lagos began trade talks with the U.S. at an Asia-Pacific Economic Cooperation summit, he wrote about the

important role Europe played in his country’s success: “When I arrived at Bandar Seri Begawan, Brunei, in November 2000, I had one thing on my mind:

trade…I decided to begin in Europe, understanding that making our case to the United States would be easier if we already had the European

Union…on board” (The Southern Tiger: Chile’s Fight for a Democratic and Prosperous Future).

Europe is definitely on board. It is the main foreign investor in Hispanoamerica, and recipient of about 15 percent of its exports. The European External

Action Service (the diplomatic arm of the EU) calls the two regions “natural allies linked by strong historical, cultural and economic ties.”

The Case of Mexico

During his presidential campaign as during these first weeks in the White House, Mr. Trump has expressed discontent regarding the many jobs

apparently taken from the US market in the manufacturing of consumable articles that will cross the border and sold in the United States. This practice,

according to Mr. Trump is advantageous only to Mexico. The subject is as vast as it is interesting and complex. As expressed in the first paragraphs of

this article, Mexico has established a large number of commercial channels with every nation in Hispanoamerica and with all nations in North America

and with a number of nations in Europe, Asia, Southeast Asia and Africa.

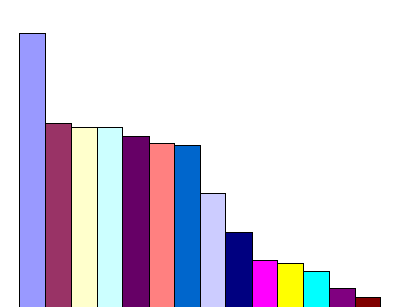

To offer a brief segment of information, let us take the automobile manufacturing in Mexico. The following map offers a great amount of information in

the area.

Carmakers have been building assembly plants in Mexico for decades. But from 2008 to 2019 they will build more plants than they did in the previous 40

years. In the following columns: Manufacturer - City and Models

If you want to offer us your opinion, click on the button labeled My Opinion. Thank you.

Toyota

Tijuana, 2003

Toyota Tacoma

Celaya, 2019

Toyota Corolla

Ford

Hermosillo, 1986

Ford Fusion,

Lincoln MKZ

Mexico City, 2010

Ford Fiesta

Fiat Chrysler

Saltillo, 1995

Ram Pickups

Saltillo, 2013

Ram ProMaster

Toluca, 1964

Dodge Journey

Fiat Freemont, 500

Hunday-KIA

Pesquería, 2016

Kia Forte

Mazda

Salamanca, 2014

Mazda 2 & 3

General Motors

Ramos Arizpe, 1981

Chevrolet Captiva, Sport

Sonic, Cadillac SRX

San Luis Potosi, 2008

Chevrolet Aveo & Trax

Silao, 1995

Chevrolet Cheyenne,

Silverado, GMC Sierra

BMW

San Luis Potosi, 2019

TBA

Volkswagen

Puebla, 1967

Volkswagen Beetle,

Golf & Jeta

San Jose Chiapa, 2016

Audi Q5

Renault-Nissan

Aguascalientes, 1992

Nissan March, Note,

Sentra & Versa

Aguascalientes, 2013

Nissan Sentra

Aguascalientes, 2017

Infinity & Mercedes Models

For carmakers one of the most attractive factors in Mexico is without a doubt the wage factor. As you can see, automakers in Mexico earn

far less per hour than those workers in Europe or the rest of North America but are still well ahead of workers in China and India.

Germany

$62.63

France

$42.23

Japan

$41.24

Italy

$41.04

Canada

$39.04

U.S.

$37.62

U.K.

$37.00

Korea

$26.03

Brazil

$17.03

Poland

$10.70

Taiwan

$9.95

Mexico

$8.24

China

$4.10

India

$2.10

Conclusion

During the last decades, manufacturers and large distributors have engaged in a war of prices to gain and penetrate new and larger markets. The central

idea is that a low price attracts more buyers, more buyers bring more revenue to the business, which is at the end of the day, the objective to achieve.

The economic relationship between manufacture versus wages, is a complex cycle to dissect in this article. It is clear that to higher salaries corresponds

a loss in international competitiveness when it comes to manufacturing and export of good and services. Countries like Mexico, with a solid economy

and a controlled inflation, are attractive to international markets precisely for the benefits manufacturers will obtain by moving their plants to a low

wage country with all the services the process demands.

What about Mr. Trump?

Business people recognize the opportunity and the benefits of manufacturing in low-wage states. With reference to the complaints that Mr. Trump has

expressed, time and time again regarding what he sees as a disadvantage for the markets and consumers in the United States, Mr. Trump himself,

practice and takes advantage of the very same benefits he complaints. There are a number of articles listing and offering detail information in this

matter. The true fact in this area is that Mr. Trump manufactures in at least 12 countries where Trump products were manufactured (China, the

Netherlands, Mexico, India, Turkey, Slovenia, Honduras, Germany, Bangladesh, Indonesia, Vietnam and South Korea). Further, Trump products transited

other countries through the packaging and shipping process — meaning workers in more than 12 countries contributed to getting many of Mr. Trump’s

products made, packaged and delivered to the United States. Here you have one of those sites